Navigating the CDMO-Sponsor Partnership

As pressures to accelerate drug delivery in the biopharmaceutical industry continue to increase, organizations must identify solutions to grow manufacturing capability while minimizing costs in record time.

Organizations are considering various options to achieve these more aggressive timelines, including leveraging new technology, streamlining supply chains and outsourcing manufacturing operations. The latter has led to an increased prevalence of contract manufacturing. By outsourcing operations to contract development and manufacturing organizations (CDMOs), biopharmaceutical companies can quickly increase capacity without requiring a large capital investment to build new manufacturing facilities. Instead of approaching contract manufacturing partnerships as short-term purchasing agreements, biopharmaceutical companies are seeking to develop long-lasting relationships with their contract manufacturers. Due to this shift in mindset and increased dependence on contract manufacturing, there are new challenges to maintaining the partnership and ensuring patients’ access to safe, effective and high-quality products.

The question of how to maintain CDMO-sponsor relationships is only one challenge the PDA Biopharmaceutical Advisory Board (BioAB) is tackling. The BioAB was founded in 2008 to provide guidance and a set strategic direction for PDA on technical topics associated with biopharmaceutical and biotechnology-related manufacturing and quality. The BioAB currently includes 20 industry experts from 15 biopharmaceutical companies. Together, the advisory board members aim to illuminate industry challenges and offer solutions and guidance.

More specifically, in alignment with PDA’s four key strategic pillars for 2020-2026 - People, Science, Regulation and Leadership - the strategic goal of the BioAB is to drive positive changes and innovation in the industry regarding raw and ancillary materials, upstream and downstream processing science for biopharmaceutical manufacturing, product class-specific considerations of emerging manufacturing technologies, quality control and product lifecycle management for vaccines, protein therapeutics and other biologics. Along with these strategic goals, the BioAB also aims to provide guidance to implement digitalization and advanced manufacturing and improve the CDMO-sponsor relationship.

Included below are past initiatives the BioAB has accomplished in pursuit of its strategic goals and on behalf of PDA:

- PDA Letter article (Q1 2023) – Vaccine Development Discussion at PDA Europe (Q3 2022)

- Technical Report (TR) No. 89: Strategies for Vaccine Development and Lifecycle Management – Jan 2023

- Commenting Effort: EMA’s Concept Paper on quality aspects of mRNA vaccines

- PDA Annual 2023 – “Meeting Patient Needs’ by Making Safe and Effective Medicines Available”

- TR No. 89 Case Studies – Webinar (Q1 2024, February)

- Rebrand Biopharmaceutical Manufacturing IG to Advanced Manufacturing & Process Digitalization IG

- Cross-industry engagement at PDA Week 2024 : CDMO Workshop (Figure 1 CDMO Workshop), Advanced Manufacturing and Process Digitalization IG Session and the Vaccine IG Session

As we look forward to the rest of 2024 and beyond, efforts include a focus on Technical Reports:

- TR No. 89 Case Studies – PDA Journal (2024)

- Revision of TR No. 69 Bioburden and Biofilm Management in Pharmaceutical Manufacturing Operations – Commencing 2024, open for volunteers

- Revision of TR No. 74 Reprocessing of Biopharmaceuticals – Commencing 2024, open for volunteers

Additionally, the BioAB-sponsored Vaccine Interest Group will continue to cooperate with the Coalition for Epidemic Preparedness Innovations and the Developing Countries Vaccine Manufacturers Network to advocate for key aspects of vaccine development and lifecycle management.

The BioAB had an opportunity to reflect on the accomplishments of 2023, highlight the 2024 and beyond initiatives and discuss the board’s strategic goals during the PDA Week 2024. As previously mentioned, one 2024 initiative is focused on how sponsors can effectively select and collaborate with CDMOs. The CDMO-sponsor relationship was a theme throughout the annual conference and was further explored in the CDMO Collaboration Workshop during the PDA Week 2024.

Main Highlights of the CDMO Workshop

The CDMO Workshop hosted by members of the BioAB was a two-day interactive session, including representatives from the U.S. FDA and from both sponsor and CDMO organizations. Experts shared their perspectives and learnings, while case-study-style exercises enabled the attendees to work together to navigate real-world challenges (see Figure 2)

Experts, including Steven S. Oh, PhD, from the FDA's Center for Biologics Evaluation and Research, shared their regulatory perspective on sponsor-CDMO partnerships. Oh used cell and gene therapy as an example and explained key challenges that must be considered, including the manufacturing paradigm shift, logistical complexities and difficulty balancing chemistry, manufacturing and controls (CMC) milestones alongside clinical activities. Regarding the latter, Oh highlighted that sponsors typically focus on clinical design and fall behind in addressing CMC requirements. For example, sponsors should target Phase Two as the optimal time to incorporate manufacturing changes so the changes can be tested in Phase Three; incorporating changes in the middle of Phase Three is too late. With reduced timelines, clinical activities often advance quickly while CMC considerations fall behind. Given the complex activities and short timelines leading up to launch, it is critical that CDMO partnerships are underlaid by strong communication and planning between the CDMO and the sponsor. Additionally, to support the partnership, it is advised that activities, such as critical quality attribute identification, product characterization and assay development, be planned as far in advance as possible between the sponsor and CDMO. Additionally, it is recommended that CDMOs and sponsors share their relevant data and learnings from past programs.

Another topic of discussion, Zeke Johnston (Viridian Therapeutics), provided insights on in-sourcing versus outsourcing and ensured the choice between the two was context-driven via case study-style examples. One case study outlined a start-up biotechnology company employing a blend of external and internal capabilities to develop their first therapy with a complex supply chain, ample funding and platform technology. Another example provided was a small company with no manufacturing capacity selecting a fully external approach to produce an approved product with a large market demand. Overall, Johnston encouraged sponsors to be flexible and aware of the ecosystem, to consider both internal and external opportunities, and to always have a “Plan C.”

There were also hands-on activities throughout the workshop. One included dividing teams into two parties: the CDMO and the sponsor. In the case study scenario, a repeat deviation at a CDMO has resulted in product loss. The CDMO and the sponsor must work together to align on a solution while ensuring strong and clear communication. Throughout the exercise, additional details on the deviations are revealed, which impact the required collaborations between the two groups.

A second activity focused on the CDMO selection process and the potential pitfalls associated with selecting a partner based solely on the lowest cost. As part of the activity, information was provided for a hypothetical sponsor looking to outsource the manufacturing of a monoclonal antibody. The requirements for manufacturing the monoclonal antibody were listed, along with six different CDMOs to select. The CDMOs had varying strengths and weaknesses, which attendees had to assess with a provided analysis tool. The analysis tool enabled the ranking of each CDMO by capabilities and resulted in a final overall score and cost. The teams had to choose between a CDMO with a higher cost and greater reliability and capability or a lower cost but riskier option. The case study culminated in a group discussion, which concluded that it is typically better to choose the higher-cost option that is more reliable, as the lower-cost option will inevitably result in additional costs in the future (see Figure 3).

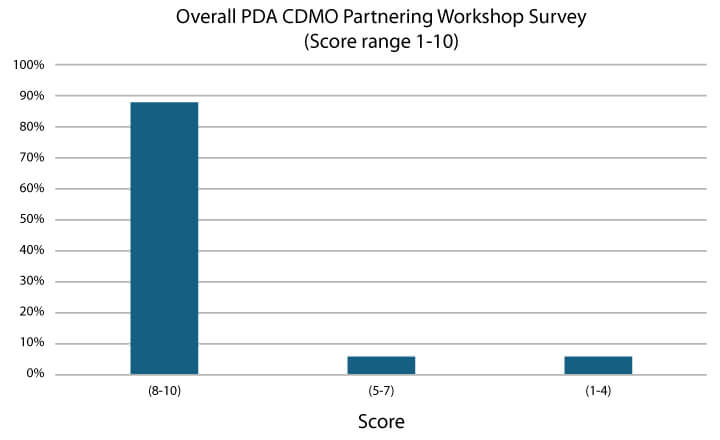

The CDMO Workshop successfully facilitated conversation between sponsors and CDMOs and supplied tangible tactics to enable a healthy, successful sponsor-CDMO partnership. The workshop received strong feedback, with almost 90% of attendees providing a high overall score of between 8-10 on a range of 1 (low success) to 10 (high success) (see Figure 4). As some attendees noted, the workshop was a good mix of topics, speakers and activities that prompted discussion in the room. It was also a great event where everyone learned from each other.

Figure 3 CDMO Workshop Case Study

Figure 3 CDMO Workshop Case Study

The expert guidance and case-study outputs described above are only a few examples of the discussion themes at the workshop. In regard to the speakers’ commentary and group activities, the challenges discussed during the workshop can be summarized by three key questions:

- How do I effectively select a CDMO?

- Can I ensure an optimal tech transfer?

- What can I do to enable an effective CDMO-sponsor relationship?

How do I Effectively Select a CDMO?

As Apneet Hayer (Roche Genentech) reflected, certain criteria are crucial to consider when selecting a CMDO. As Hayer noted, it is important to confirm the CDMO’s track record with agencies, open investigations, financial health and documentation capabilities, as well as technical aspects, including equipment availability, drug substance vs. drug product manufacturing ability, testing requirements and more. Ultimately, these considerations are defined by the following: quality, cost, time, risk and adaptability.

Beyond the key requirements, Hayer also recommends clarifying whether a sponsor is looking for a short, transactional or long-term relationship. Depending on which relationship is appropriate, the criteria and approach may differ. For example, if the goal is a long-term relationship with the CDMO, the sponsor may want to take some extra steps to understand the culture at the CDMO. These steps may include gauging CDMO responsiveness based on attendance at meetings and responses to emails, getting a pulse on the CDMO's interest in the product to be manufactured and reading between the lines regarding company culture and communications. For instance, Jay Howlett (Vir Biotechnology, Inc.) described statements like "That will be very difficult," likely meaning "No." Additionally, it is important to understand the CDMO's team members. Do they have project managers? Do they have sufficient quality assurance representation?

Fi Alonso (Pfizer – retired) highlighted that it is important to complete a site visit prior to selection to ensure the CDMO is more than the brochure and website. A site visit can uncover issues that might otherwise have been missed.

Can I Ensure an Optimal Technology Transfer?

Once a CDMO partner has been selected, the sponsor must ensure the CDMO is appropriately prepared to manufacture the product via a robust tech transfer. There are three types of tech transfer: internal to internal, internal to external and external to external. The last is the least straightforward.

As Beth Haas (Haas Pharma Consulting) noted, regardless of the type of tech transfer, the process should start an initiation and consider the common pitfalls of tech transfer. Brandon Haigh (WuXi Advanced Therapies) discussed the eight key pitfalls: unrealistic timelines, misaligned information, inadequate training, failure to communicate, unclear roles, lack of material readiness, testing-related delays and vague agreements.

When executing a technology transfer, it is important to build a robust process that works every time to avoid repeat deviations and conflicts between the CDMO and the sponsor. For example, one action to ensure a robust process is to complete at least two engineering batches. Remember, if it does not work in small scale, it likely will not work in large scale.

What can I do to Ensure an Effective CDMO-Sponsor Relationship?

Once the relationship is in a business-as-usual state, how can a sponsor establish a long-standing, healthy relationship? The goal is for the CDMO to become an extension of the sponsor company by building a symbiotic partnership. Building a long-lasting relationship means establishing trust. For example, as Jay Howlett described, a contract will always have gaps. Still, if the sponsor has established a win-win relationship with their CDMO, the two entities can work together as a team rather than working through change order after change order. Ultimately, the two entities should have a joint vision statement that aligns them on what a “successful” working relationship should mean regarding the cultural mindset and defined metrics to work towards.

Lastly, as Morten Munk (FUJIFILM Diosynth Biotechnologies) explained, it is critical to ensure a robust conflict management plan is in place. First, ensure quality is involved with Master Service Agreement (MSA) discussions and know who the decision-maker is in critical conversations. In addition, promote team-building activities and congeniality amongst the teams, then watch for periods of high stress and find ways to destress.

Conclusion

The more pharmaceutical sponsors rely on the CDMO growth trajectory due to the boom of innovative medicines and a shift away from small molecules, the more critical it will be to ensure appropriate capabilities and develop strong relationships between the CDMO and the sponsor. Through robust assessment of CDMOs, strong management of the technology transfer, and transparent communication throughout the relationship, contract manufacturing can continue to help enable accelerated product development. As the biopharmaceutical industry navigates these complex challenges, PDA and the BioAB will be at the forefront of promoting cross-organization collaboration and solutions.