New Serialization Regs Impact Global Pharma

Pharmaceutical companies must deal with challenges stemming from supply chain security lapses (resulting in theft, diversion and product recalls), counterfeiting and stringent regulations. These challenges also impair the health of the industry by adversely impacting profits, brand credibility and research initiatives.

With industries and governments around the world realizing the complexity of implementing product serialization programs, pharmaceutical manufacturers in the United States are already busy attempting to comply with our own federal track-and-trace legislation, part of the Drug Supply Chain Security Act (DSCSA). This law took effect in 2015 and not only applies to U.S. drug manufacturers, but also to wholesalers and pharmacies that buy, distribute and dispense medications in the United States. The DSCSA includes certain milestones for phasing in compliance across the drug supply chain over a ten-year period; full traceability is intended to be implemented by 2023.

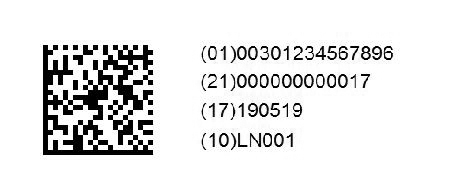

GS1, a non-profit organization, has emerged as a unifying force within the drug industry as it seeks to establish standards around serialization. This organization develops and maintains global standards for business communication. The best known of these standards is the barcode, similar to the one a cashier scans at the checkout counter. GS1 has actively participated in the worldwide adoption of standards around barcodes for DSCSA-compliance. They do this by defining protocols around linear bar codes, such as Serialized Shipping Container Codes (SSCC) and 2-D data matrix codes that can encode required information. A serialized barcode (Figure 1) contains, at a minimum, a Global Trade identification Number (GTIN)—unique to individual drug products and companies, serial number, lot number and expiration dates.

Figure 1 shows the application identifiers (two-digit prefixes with parentheses around them). The application identifier that begins with (01) stands for the 14-digit GTIN that includes the embedded NDC number with a check digit at the end. The (21) identifier serves as the serial number; this can go up to 20 digits. The (17) 190519 is the expiration date in YYMMDD format, i.e., May 19, 2019. And (10) LN001 is the batch number.

Serialization Dominates the Globe

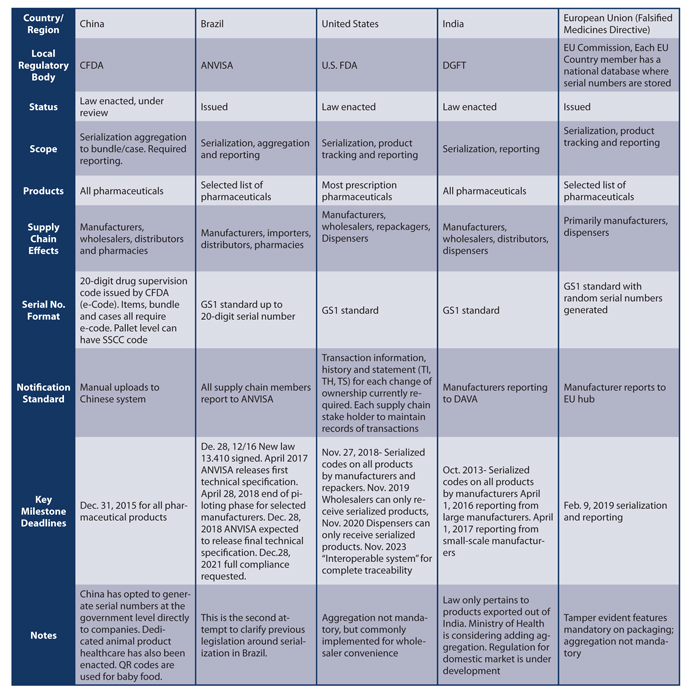

The United States is not alone in expanding serialization requirements. U.S. drug companies planning to export their products overseas for sale need to carefully navigate changing serialization requirements in other markets. Countries have adopted different standards around unique identifiers (serial numbers) and regulatory reporting which must be strictly adhered to. Some countries require aggregation: the reporting of the parent-child association between packaged items (lowest saleable unit) and the next box or packing unit it goes into (case or bundle) all the way to the pallet. Aggregation helps subsequent buyers of serialized product scan the outer-most barcode and know all the individual items and groups packed within it. Although aggregation is not a requirement in the European Union or United States, many major drug distributors (e.g., Amerisource Bergen, Cardinal and McKesson) have requested their customers ship aggregated products to aid in efficiently identifying serial numbers within pallets and cases of received shipments and inventory.

Serialization is having a ripple effect throughout companies by changing the way pharma companies manufacture along with their product labeling and packaging operations. Regulatory compliance is now more complex, as is IT integration with other systems and trading partners for exchanging serialized data about transported goods. Companies should take care to analyze the commercial markets where they exchange their products to make sure they are up to date and compliant. Table 1 covers some of the major pharmaceutical markets in the world and the serialized laws that have been passed.

Over the next decade, there will be a seismic shift in how pharmaceuticals are manufactured, packaged and distributed throughout the world. Ultimately, the regulatory laws governing each country will have a ripple effect within companies, affecting everything from the redesign of labels to accommodate required serial numbers and barcodes to the exchange of transactional information between trading partners like wholesalers and pharmacies. Care should be taken to understand, leverage and adopt standards (such as GS1 standards) to meet these challenges and provide a framework for future compliance. Aggregation has the potential to add more complexity and cost to the serialization process, and companies should plan accordingly as this is increasingly becoming a requirement. Finally, although the countries mentioned in Table 1 are proactive in their measures to secure the drug supply, one should consider serialization an evolving compliance issue in which change is inevitable.

But do not make the mistake of sitting on the sidelines to see the eventual outcome. The laws and penalties for not complying with serialization today are severe and costly, consequently, they should be followed as stringently as possible.